Compensation is about more than numbers and can be an emotional topic because it also touches on notions of fairness and self-worth. Unfortunately, these emotions can produce bad decisions. At RevelOne, we see hundreds of offers a year and talk to candidates as they wrestle with major career decisions.

We’ve seen marketers choose jobs based on the last few thousand dollars when they might end up burning years in the wrong role, miss out on a huge equity win, or lose the opportunity to develop key skills. And given the evidence of the gender pay gap and other signs of inequality, having a thoughtful and data-driven approach to assessing compensation is more important than ever.

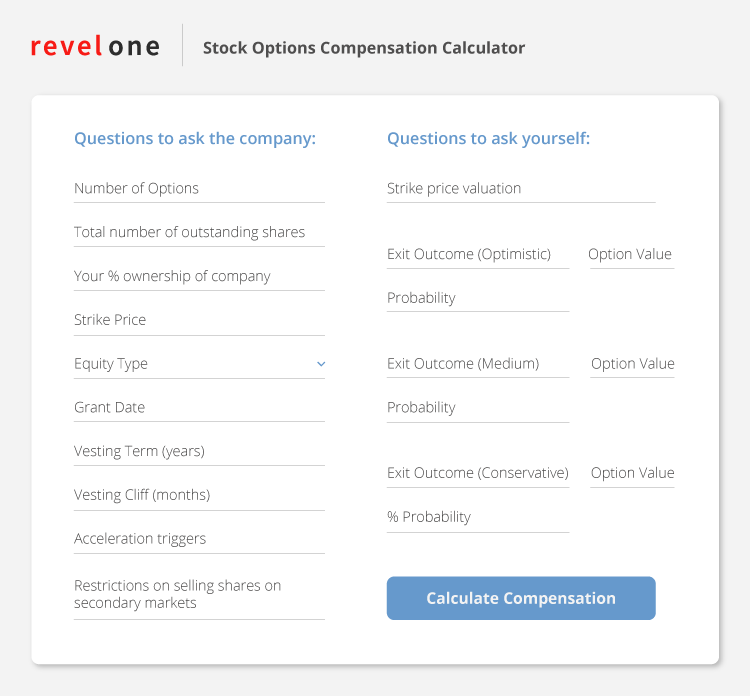

Below are some important factors to consider when evaluating an offer. We also provide a tool that can help you understand and calculate the value of your startup compensation package across a range of scenarios.

Important Factors to Consider

- Think deeply about your personal situation and risk profile.

-

- Can you take a lower salary in exchange for higher equity that can be life-changing if your company is successful? Or, to build skills that will increase your future earnings trajectory?

- Do you have a high mortgage or expenses and need more predictable cash flows?

- Are you willing to increase your earnings by tying more of your salary to incentive-based compensation that depends on the results you deliver?

- Negotiating for more equity sends a positive message to hiring companies because it shows you are aligned with their performance and mission.

- Similarly, shifting some base salary to a performance-based bonus signals confidence in your abilities.

What Is Your Equity Worth?

Equity is a critical part of your compensation, but it is also highly complex and often not well understood. Just knowing the number of options you have isn’t enough. You need to know:

- Strike price

- Ownership percentages/shares outstanding

- Potential exit valuations (find out the most recent valuations and model three scenarios for exits including low, medium, and “home run”)

- Liquidation preferences (these preferences can actually drive the nightmare stories you hear where companies get sold but employees walk away with nothing)

Stock Options Value Calculator

To help you understand your equity value, we created a downloadable Excel sheet that guides you through the key variables and calculates the value of your options.

It’s a great tool to use before you accept an offer and be sure to keep it updated after you join a company.

About RevelOne

RevelOne is a leading marketing advisory and recruiting firm. We do 300+ searches a year in Marketing and Go-to-Market roles from C-level on down for some of the most recognized names in tech. For custom org design, role scoping, and retained search, contact us.